As Market Depth, we mean the total quantity requested and offered within a range of prices and is a very useful graph to find out the support that exists below the current price and the resistance above it. It is typically a visualization of the Order Book and therefore its drawback is that it cannot capture the orders that are going to be made using the "market taking" method. The greater the Depth of the Market, the more difficult it is to have a sharp fall in price.

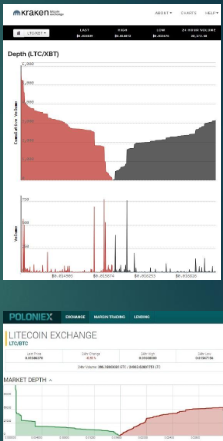

In order to achieve a more reliable estimate of the Market Depth, it is advisable to be checked not only on one platform but on other platforms as well- if possible. For example, in the first picture we have the Mark Depth for Litecoin (LTC) as depicted at a specific moment in Kraken, while in the second picture we have the Market Depth for the same coin and at the same time as depicted in Poloniex. Their trading volume for this 24-hour trading was the same, so the impact on the market was the same. If we checked Market Depth only at Kraken, we would have the exact opposite results from what Poloniex would give us. However, crossing the graphs from both sources, we see that there is no clear indication of whether the support is smaller or greater than the resistance and that the probability of an increase in price is in line with the chance of a decrease.

---