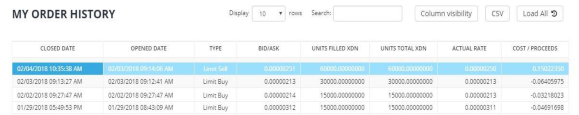

In the example below, we bought XDN coin for an implementation of the methodology we developed previously:

• We set our profit rate at 5%.

• On 29/01/2018 we bought 15,000 XDN at 0.00000312 BTC and we set a sell price at 0.00000328BTC.

• On 02/02/2018 and after the price dropped significantly, we bought another 15,000 XDN at the value of 0.00000214, which we should sell at the price of 0.00000225. The average selling price for the two purchases we've now made is: (0.00000328 + 0.00000225) / 2 = 0.00000277 BTC.

• On 03/02/2018 and after the price has stabilized at a low level, we bought an additional 30,000 XDN at the price of 0.00000213, which we should sell at the BTC 0.00000224. The average selling price for the 3 buys we made as a whole is now formed as follows: (0.00000277 + 0.00000224) / 2 = 0.00000251 BTC.

• On 04/02/2018 we achieve the sale at the target price, with total profit 0.00706654 BTC.

---